Numbers Without Numbers

Canada's non-bank mortgage market is growing. How are you coping?

Today we’re going into the sheer numbers in the alternative mortgage space. Ironically, without using too many numbers. I was recently reading a memoir of a founder I quite respect and one line in particular stood out to me…

“The irony of numbers and statistics is they can lie, be manipulated, misunderstood, or otherwise bastardized when my argument could have been just as accurate without them.

I do not aim to lead you astray, dear reader, but rather to make my point without getting lost in the minutiae. Why bother counting the brush strokes when the whole painting evokes an emotional response?”

And while we likely won’t get quite as artistic as the quote above, we can certainly focus on some trends in the mortgage space without getting lost in the minutiae.

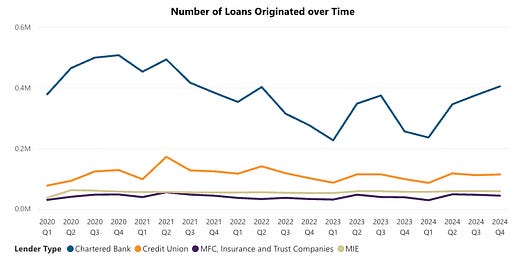

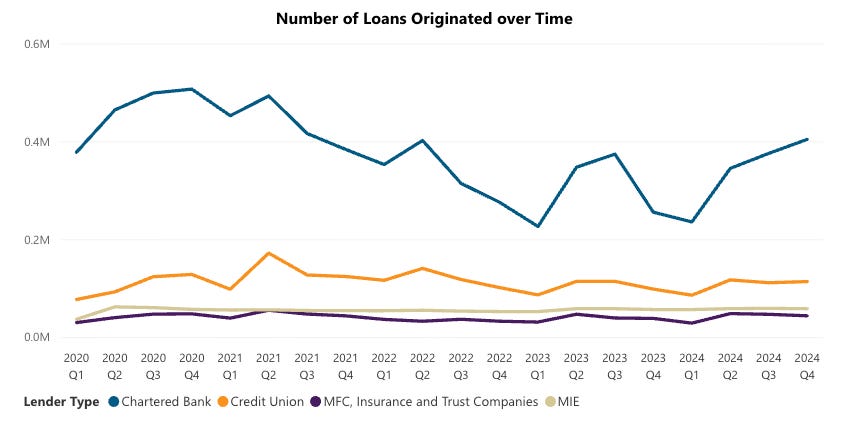

So here are some (rough) stats about the Canadian mortgage market per CMHC:

Roughly 85-90% of mortgages originated in Canada in 2024 were through a bank, credit union, or mortgage finance company. In other words, “prime” lenders.

Still, more than $63 billion worth of mortgages were originated through Mortgage Investment Entities (MIEs). This number likely accounts for construction and multi-family residential loans.

MIE originations have run flat for 19 of the last 20 quarters.

See that MIE line second from the bottom? That’s not a stagnation in the originations market, that’s MIEs deploying all of their capital on a consistent basis for the last half-decade. Available datasets show this trend extending before 2020 and continuing in 2025 as well. MIEs literally cannot find capital quickly enough to keep up with demand.

For those of you who haven’t had a chance to read previous DabbleCap posts, there is a trend emerging in Canada’s mortgage market due to B-20 regulations. B-20 was introduced in late 2016 to strengthen Canada’s prime lending space and tighten credit requirements.

It split the prime market into two categories - insurable and uninsurable. The former describes loans that are eligible for bulk default insurance then sold off through the Canada Mortgage Bond (CMB) programme. The latter are still considered “prime” but typically sit on a lender’s balance sheet.

CMB loans carry a federal guarantee. Uninsurable loans are funded through depositor dollars that are also federally guaranteed through Canada Deposit Insurance Corporation (CDIC).

Now remember Canada has a spending problem. We have run a federal deficit for over a decade and a major impediment to further spending is the obligation under the CMB and CDIC programmes. B-20 has sought to curb that obligation by tightening prime credit consistently for the last nine years.

What happens when the borrowers don’t change but the lenders’ credit bucket keeps shrinking? Those borrowers fall down the credit curve. Quarter after quarter. Announcement after announcement.

There are some branches to catch these borrowers as they fall but a large majority of those otherwise-prime borrowers land in the MIE space. We’re talking in the billions of dollars. MIEs, lenders built for short-term workout financing, now shifting their underwriting and funding to these more “prime” borrowers are still beholden to their current investor base expecting 9%+ yields year over year.

Here’s how the (rough) math works:

A “pseudo-prime” borrower no longer qualifies at their bank so they turn to the non-prime market.

Prime rates are 4% and MIE’s typically write loans at 10% short-term loans and for poorer-quality borrowers.

The pseudo-prime borrower, along with hundreds of his peers, complains and gets an MIE to put out a 6.5% product.

The MIE’s investors still want 9% yield and the company still needs 1-3% in fees to stay afloat.

The MIE adds fees (as though that’s not a higher rate), back-levers their fund with cheap bank debt, takes the excess spread, and pays the investor and themselves something familiar.

The pseudo-prime borrower gets a 1-yr mortgage (because that’s what MIEs are used to) and has to re-qualify all over again next year.

The above is a dumbed down version of how an otherwise competent borrower meets an otherwise suited lender but with a mismatch in capital needs. Borrowers need options. MIE funds are purpose-built for short-term lending.

So why doesn’t a new lender come in and challenge the incumbent by putting out longer-term paper at 6.5% and serve this underserved market? One, because it’s likely an international capital source used to 30-year paper trying to make sense of 1-5-year paper amortized over 30 years. And two, because the MIEs have their secret weapon - they can originate almost $65 billion per year with their eyes closed (see above) with constant demand for more of their money.

Canada doesn’t need more lenders. Nor should MIEs be expected to carry the burden of fitting a square peg in a round hole with poor product market fit. Instead, there’s a trend emerging of strong originators (the MIEs) working with diverse capital (the longer-term 6.5% investors) to bring about a new era of lending in Canada.

Rather than looking at the prime market as being bifurcated into insurable and uninsurable, we should be thinking about Canada’s entire market as prime and non-prime. The latter should have just as much liquidity and infrastructure so as to alleviate concentration risk on the government and provide better options to Canadian borrowers.

Canada’s new mortgage market has robust capital infrastructure in the prime space as well as ample capital and risk sharing in the non-prime space (similar to our monoline lenders).

That is why we built Dabble Capital Advisory. We believe that MIEs are running at full speed while trying to repurpose their existing capital stack. When instead, there is a broader, more lucrative, and dare I say, more fitting way to 2x, 3x, or even 10x that $63 billion in the coming years.

If you’re new here - let’s connect on how your fund can expand or your capital can be put to better and safer use.

**This newsletter segment is under the “For Investors” section of the Dabble Capital Advisory Newsletter. If you are looking for different information on the mortgage market, be sure to subscribe to the right channel - For Borrowers, For Lenders, or For Brokers. We’re building a community at DabbleCap and we invite you to learn and contribute.**

Very well written. Speaks to some trends we’ve been noticing as well. Great piece.